Preferential policies for microgrid enterprises

The Impact of Preferential Tax Policies on Corporate Investment

preferential policies such as tax credits, tax exemptions or tax deferrals, allowing enterprises to enjoy more tax exemptions or preferential treatment on the income gained from investment

Frontiers | Microgrid Policies: A Review of Technologies and Key

A microgrid policy appeared in the Thailand 2015 energy development plan. There are many microgrids in Thailand. The first smart microgrid in Thailand is in active

Preferential tax policies_Taxation

These preferential tax policies include: (1) High-tech enterprises enjoy apreferential tax rate of 15; (2) From January 1, 2021 to December 31, 2022, for the portion of

New energy policy and green technology innovation of new

Under policy guidance, enterprises conduct technological research to protect the environment and improve their efficiency. As a result, the benefits of GTI can compensate for

Interpretation of Tax Preferential Policies and Tax Planning

In recent years, China has introduced various tax relief, financing tax support and other policies and measures to promote the development of small and micro enterprises.

Policy and market mechanisms for promoting sustainable energy

This study looks at China''s supportive market and regulatory frameworks for a sustainable energy transition. It examines how public and commercial sectors help shift to

Assessing the Feasibility of Solar Microgrid Social Enterprises as

The objective of this paper is to set out the argument for Solar Microgrid Social Enterprises (SMSE) as a conduit for achieving SDG7. Section 2 comprises a literature review of

Research on the Influence of Preferential Tax Policies on

investment. Due to the preferential tax policy, enterprises can enjoy lower capital cost when making capital budget and investment decisions, thus improving the internal rate of return of

More than Affirmative Action: China''s Preferential Policy in the

preferential policy in education provides a good entry point for exploring China‟s preferential policies in general. The following is a broad strokes analysis, by period. The analysis is

(PDF) Overview of Current Microgrid Policies,

In this paper, a clear view on microgrid policy instruments and challenges are investigated toaid future developments. Renewable power

Announcement on the Matters Concerning the Implementation of

To carry out the Announcement of the Ministry of Finance and the State Taxation Administration on the Implementation of Preferential Income Tax Policies for Micro

Analysis of the Impact of New Tax Policy on Small and Low-Profit

Compared with the previous tax policy, the new tax policy has expanded the preferential scope of the tax policy for small enterprises, which is reflected in the tax base and time. Under the

Microgrid Policies: A Review of Technologies and Key

microgrid policy appeared in the Thailand 2015 energy development plan. There are many microgrids in Thailand. The first smart microgrid in Thailand is in active operation.

(PDF) Tax Preference, Policy Incentive and Enterprise

Tax Preference, Policy Incentive and Enterprise Innovation—Based on the Development Status of China''s New Energy Vehicle Industry January 2021 Advances in Social Sciences 10(04):989-995

Policy incentives, government subsidies, and technological

In order to accurately identify the causal effect of policy incentives on the technological innovation of NEV enterprises based on the NEVPC policies jointly announced

Policies and Prospects to Promote Microgrids for Rural

The market of MG and mini-grid is promptly emerging due to low carbon emission, cost-effectiveness, and diversification of energy sources (Understanding microgrid

Announcement of the State Taxation Administration on Issuing the

Among them, enterprises enjoying preferential items for IC manufacturers, IC design enterprises, software enterprises and key software enterprises and IC design

Guidelines on Preferential Tax and Fee Policies Supporting Green

To strengthen environmental management and governance, significantly reduce the intensity of pollutant emissions, reduce the impact of industrialization and urbanization on

Announcement of the State Taxation Administration on Matters

For the purposes of implementing the Announcement of the Ministry of Finance and the State Taxation Administration on Implementing the Preferential Income Tax Policies for Micro and

Research on preferential tax policies for small and medium-sized

This study investigates the relationship between tax policies, investment decisions, business growth, and economic growth in Micro, Small, and Medium-Sized

Government Incentive Contracts for Microgrid Users

Tariff subsidies are beneficial to the further development of the microgrid market. In response to the reduction of the power generation costs of microgrids, the energy storage subsidy for microgrids has become a key factor

Do government subsidies promote efficiency in

Furthermore, governmental policies should be instrumental in granting small and medium-sized enterprises a more relaxed policy environment to help them build confidence for

Government Incentive Contracts for Microgrid Users

Haber [22] studied the implementation effect of microgrid power generation tax policies among European countries. Davos suggested that the key point of developing

Socially optimal deployment strategy and incentive policy for

However, feed-in tariff policy may inhibit a healthy market competition by giving a preferential price and increase financial burden on one in microgrid technologies and

China Preferential Tax Policies to Support Small and Micro Enterprises

Recent years, China has released a series of preferential tax policies to promote the development of small and micro enterprises. Kaizen hereby summarizes the preferential tax policies

Announcement on Tax and Fee Policies for Further Supporting the

The preferential policies on income tax for individual businesses in the Announcement of the Ministry of Finance and the State Taxation Administration on the Further

Overview of Current Microgrid Policies, Incentives and Barriers in

sustainability Review Overview of Current Microgrid Policies, Incentives and Barriers in the European Union, United States and China Amjad Ali 1,2,*, Wuhua Li 2, Rashid Hussain 1,

6 FAQs about [Preferential policies for microgrid enterprises]

Do policies and incentives hinder the deployment of microgrids?

However, apart from the technical challenges, fewmicrogrid studies exist on effective policies and incentives for microgrid promotion and deployment.This survey investigates the policy, regulatory and financial (economical and commercial) barriers,which hinder the deployment of microgrids in the European Union (EU), United States (USA) andChina.

Are microgrid policies related to distributed energy policies?

Many studies exist on microgrid technologies and operation, but few studies on policies, incentives and barriers to microgrid promotion and deployment. It is to be understood that microgrid policies are unavoidably related to distributed energy polices and precisely renewable energy.

What barriers hinder the deployment of microgrids?

This survey investigates the policy, regulatory and financial (economical and commercial) barriers, which hinder the deployment of microgrids in the European Union (EU), United States (USA) and China. In this paper, a clear view on microgrid policy instruments and challenges are investigated to aid future developments. 1. Introduction

How effective is microgrid implementation?

If the policies and regulatory factors discussed can be addressed, effective microgrid implementation can rapidly move forward. However, the currently intertwined regulatory and policies barriers are impeding MG deployment rate.

What policies have been implemented to promote the development and adoption of microgrids?

Several countries have implemented policies to promote the development and adoption of microgrids. In the United States, the Federal Energy Regulatory Commission (FERC) has implemented Order-2222 , establishing rules enabling microgrids to participate in wholesale energy markets.

Why are regulatory and policy frameworks important for microgrids?

Regulatory and policy frameworks are crucial in facilitating the growth and acceptance of microgrids. However, several challenges related to these frameworks need to be addressed. One of the primary issues is the variation in regulations that govern microgrids across different countries and states.

Related Contents

- Microgrid policies in various regions

- Microgrid Virtual Synchronous Compensation

- New Energy Microgrid Files

- Microgrid operation standards

- Microgrid implantation

- The state solicits microgrid management measures

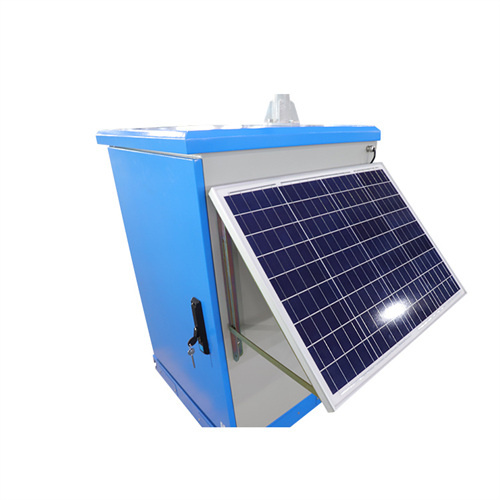

- Photovoltaic microgrid operation on campus

- Microgrid Cost-Benefit Analysis

- Xiongxiong Microgrid

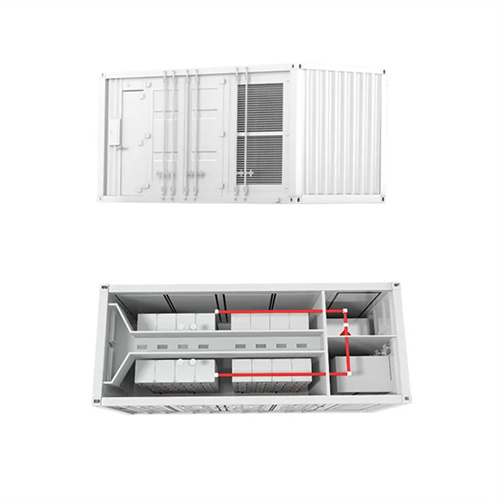

- New Energy Microgrid Equipment

- Papers on Microgrid Communications

- Microgrid and wall-mounted electricity sales